- Most recent 15-12 months mortgage costs

- 15-seasons against. 30-seasons mortgages

- Try a great fifteen-year financial best?

- Advantages

- Speed trend

- How to find an informed costs

- Are good 15-season mortgage best for you?

- What are my personal additional options?

Associate backlinks into facts in this article are from partners you to make up all of us (get a hold of our very own advertiser disclosure with our a number of partners to get more details). Although not, the views is our own. Find out how i rates mortgages to enter unbiased studies.

The fifteen-seasons mortgage, whether or not significantly less common as ubiquitous 31-seasons financial, are a substantial money-protecting choice for borrowers who can pay for more substantial payment per month.

Given that terminology try shorter and you may fifteen-year mortgage pricing is less than 31-season pricing, you might conserve hundreds of thousands of dollars over the longevity of the loan from the going for a 15-season repaired-speed mortgage.

How do 15-year mortgage prices compare to 30-season costs?

Since they are reduced conditions, 15-seasons fixed financial cost was below 29-season prices. Here’s how 29-seasons and you can fifteen-year home loan prices possess trended over the last 5 years, according to Freddie Mac studies:

Straight down rates of interest

Average fifteen-seasons pricing are below 29-12 months mortgage costs just like the you might be signing up for a shorter title, which is much safer towards the bank. That is the general code: The latest faster their repaired-price name, the reduced the speed. Additionally pay smaller inside the attention historically having good reduced name, given that you can easily pay-off the loan sooner or later.

Complete interest discounts

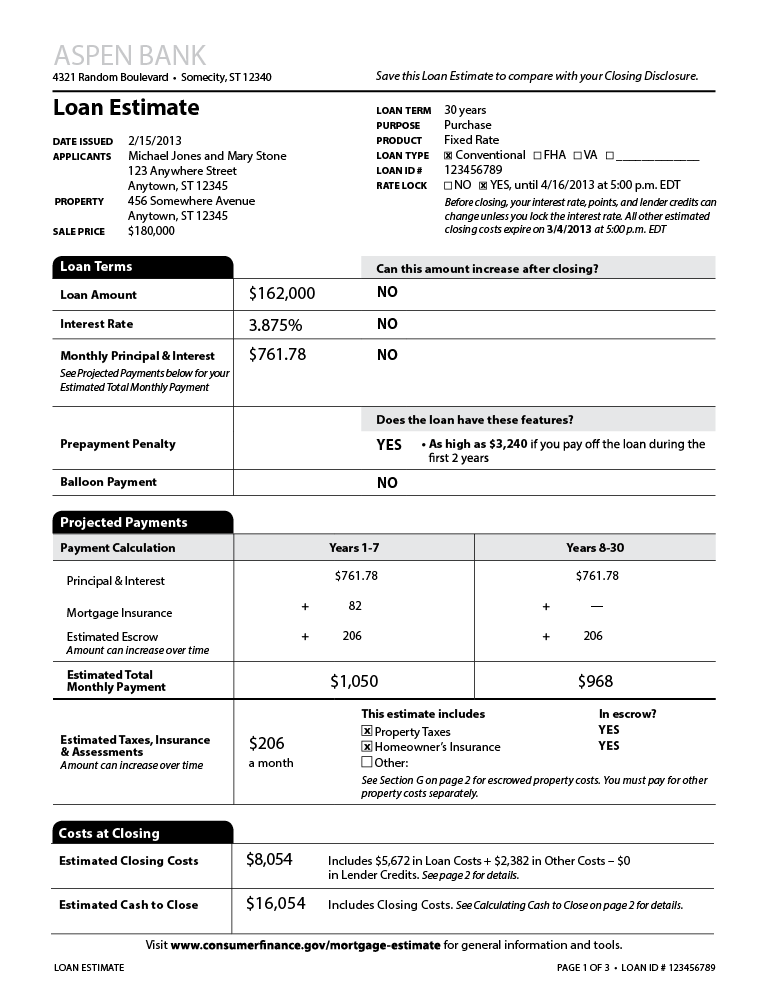

To see how much cash you might rescue full with a great fifteen-year repaired-rate mortgage, read this fifteen-12 months financial price comparison to have good $250,000 loan, using average interest levels towards few days away from September 19, according to Freddie Mac study:

Towards the end of one’s term to the 30-12 months loan, you’ll have reduced almost $300,000 in the attract. Good 15-season loan could save you almost $200,000 compared.

“As much as possible easily manage an excellent fifteen-12 months financial, then they should consider they,” states Melissa Cohn, local vp in the William Raveis Financial. “Prices with the an excellent 15-12 months is actually much more below a 30-season, and the complete discounts with the interest costs is actually extreme!”

Pay-off their financial sooner or later

If you intend to stay in your home for some time day, you can prefer an excellent 15-year home loan while the it is possible to repay your home loan eventually and you will work with regarding possessing your property 100 % free and you will clear. Additionally create equity more easily, which you yourself can upcoming access using a property equity loan, HELOC, or cash-away refinance.

15-season mortgage rates trends

Home loan prices had been coming down across-the-board lately. Into the August, average fifteen-year fixed financial costs decrease so you can 5.38%, down 42 foundation issues in the prior month’s mediocre, based on Zillow investigation. Pricing was in fact also low in .

What were a minimal 15-year home loan pricing?

A reduced mediocre fifteen-season financial rates ever filed was at middle-2021, whether or not it dropped so you’re able to 2.10%, predicated on Freddie Mac computer.

Into the pandemic, home loan prices struck historical downs, and 15-season mortgage rates neared 2%. However, they’ve improved substantially ever since then, trending right up easily during 2022 and you will 2023. Even when they might be for http://paydayloanalabama.com/elkmont the last off has just, cost will always be sometime increased. Its unrealistic they go as little as they were inside pandemic once again.

15-season home loan rates forecast

Financial rates have been decreasing has just, and perhaps they are expected to slip after that within the 2025. How much they slide depends on the economic frame of mind and how much the fresh new Federal Set-aside works out decreasing the federal loans price.

How to locate an educated 15-season mortgage costs

Loan providers take your money into account whenever choosing mortgage. The higher your financial situation try, the lower your rate would-be.

- Deposit: Based on which kind of home loan you’re taking aside, a lender may need between 0% in order to 20% for a down payment. Nevertheless significantly more you’ve got to own a down payment, the lower their price will likely be.

You should be able to find a low 15-12 months fixed financial rates which have a large advance payment, advanced credit score, and you will low DTI proportion.

Explore the totally free mortgage calculator observe how newest fifteen-12 months financial prices usually affect your own monthly payments and you can enough time-title funds.