Aly J. Yale c overs a residential property, mortgage loans, and personal financing. Their particular work could have been typed into the Forbes, Organization Insider, Money, CBS News, United states Development & World Report, therefore the Miami Herald. She’s a bachelor’s education within the journalism regarding Bob Schieffer School out of Telecommunications from the TCU, that’s a person in the fresh Federal Relationship out-of A property Editors.

While a homeowner, while instantly end up with unforeseen will set you back or higher expenditures to fund-think family restoration, university tuition, or a down-payment toward an investment property-you happen to be comparing if or not a house security financing otherwise an excellent consumer loan is actually a better way to find the fund your you prefer.

That’s of course, however, which you have produced enough money on your mortgage to build equity of your home which you happen to be willing to tap they that have what’s often called an additional mortgage.

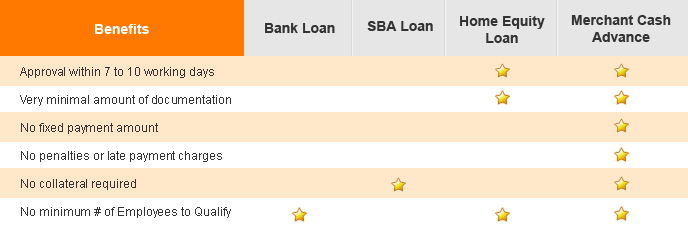

While you are one another possibilities could offer you a lump sum payment of cash, they’re not similar. A person is even more suited to less mortgage numbers, is easier to be eligible for, that will charge you a great deal more (however, will not place your family at risk). The other offers big amounts, all the way down cost, and you will offered mortgage terms, it is safeguarded by the house.

Domestic equity funds against. unsecured loans

Domestic guarantee funds and personal fund are a couple of methods borrow funds. That have a property collateral financing, you borrow secured on new security you really have in the house (the fresh new area you probably individual) in exchange for a lump sum payment. These funds usually are approved from the banks, credit unions, and you will mortgage brokers.

Personal loans, as well, require no security (we.age., an asset a lender allows while the defense for stretching financing) and tend to be available due to very creditors and you will lenders.

Signature loans are around for individuals who cannot very own a property, says Barry Rafferty, senior vp out of financial support avenues in the Reach. Unlike home collateral, lenders make choices considering income, credit score, and you may loans-to-income ratio.

In both cases, consumers rating an upfront lump sum payment, also fixed rates of interest and you will consistent monthly obligations over the lifetime of your Hawai loans loan.

Even with its similarities, whether or not, household security fund and personal finance commonly you to definitely together with exact same. See the key differences when considering these two sorts of fund below.

What is a home collateral loan?

Property guarantee financing was a loan using your own collateral stake-your own home’s value, minus what you owe inside-because the power. Then you score a fraction of you to security back in bucks.

You can aquire a house guarantee loan having anything from $5,000 to $five-hundred,000, according to restrictions from the financial institution, says Nicole Rueth, older vice president of the Rueth Party at OneTrust Mortgage brokers.

House collateral finance try commercially a form of next home loan, definition they’ve been using towards the head mortgage. If you fail to generate repayments, your primary home loan company enjoys a claim to the house earliest, accompanied by your house equity bank. Likewise, family equity money add the second monthly payment on the house (on top of most of your homeloan payment).

Just how household security money functions

When taking away a property security mortgage, you’re getting a lump sum payment after closing. You to harmony-and additionally appeal-are pass on all over your financing term, that range any where from five to help you 3 decades. Just like the rates on these money was repaired, your instalments will stay uniform for the entire term.

To get property collateral loan, you’ll need to be a citizen and also have paid a beneficial fair share of your mortgage. Extremely lenders require that you provides at the least 10% in order to 20% security of your property. So you can determine their collateral, bring your house’s reasonable market price (you can examine together with your local appraisal section because of it) and deduct your current home loan harmony. Up coming separate one to number by the residence’s value. Such as for instance, if your home’s really worth $five-hundred,000 as well as your financial equilibrium is $eight hundred,000, you may have $100,000 in home guarantee-or 20%.